![]() CoreLogic’s latest Equity Report revealed that 256,000

properties regained equity in the third quarter of 2015. This is great news for

the country, as 92% of all mortgaged properties are now in a positive equity

situation.

CoreLogic’s latest Equity Report revealed that 256,000

properties regained equity in the third quarter of 2015. This is great news for

the country, as 92% of all mortgaged properties are now in a positive equity

situation.

Price Appreciation =

Good News For Homeowners

Frank Nothaft, CoreLogic’s

Chief Economist, explains:

“Home price growth continued to lift borrower equity positions

and increase the number of borrowers with sufficient equity to participate in

the mortgage market. In the last three years, borrowers with at least 20 percent

equity have increased by 11 million, a substantial uptick that is driving rapid

growth in home equity originations.”

Anand Nallathambi, President

and CEO of CoreLogic, believes this is a great sign for the

market in 2016 as well, as he had this to say: “Homeowner equity is the largest source of wealth for many

Americans. The rise in home prices, expected to be at least 5% in 2016,

will continue to build wealth and confidence across America. As this process

continues, it will provide support for the housing market and the broader

economy throughout [the] year.”

This is great news for

homeowners! But, do they realize that their equity position has changed?

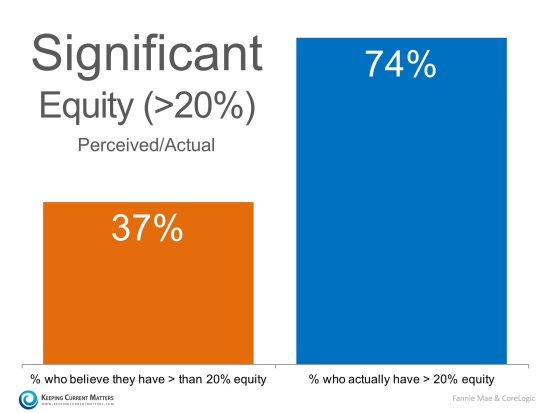

A study by Fannie Mae suggests

that many homeowners are not aware that they have regained equity in their home

as their investment has increased in value. For example, their study showed

that 23% of Americans still believe their home is in a negative equity position

when, in actuality, CoreLogic’s report shows that only 8% of homes are in that position (down from 9% in Q2). The

study also revealed that only 37% of Americans believe that they have

“significant equity” (greater than 20%), when in actuality, 74% do!

This means that 37% of Americans with a mortgage fail to realize

the opportune situation they are in. With a sizeable equity position, many

homeowners could easily move into a housing situation that better meets their

current needs (moving to a larger home or downsizing).

Fannie Mae spoke out

on this issue in their report:

“Homeowners who underestimate their homes’ values not only

underestimate their home equity. They also likely underestimate:

1) how large a

down payment they could make with their home equity,

2) their chances of

qualifying for mortgages, and, therefore,

3) their opportunities for selling

their current homes and for buying different homes.”

Bottom Line

If you are one of the many Americans who are

unsure how much equity you have built in your home, don’t let that be the

reason you fail to move on to your dream home in 2016!

Call The Militello Team today at (978) 500-1480 and ask for Kathleen. We can help you by providing you with an "Opinion of Value" on your property at no cost to you. Then based upon what it is you would like to do, we can guide you through that process whether it be selling your home and purchasing one that better meets your needs or simply refinancing and making improvements to your current situation.